Other Service

- ATM Services

- Safe Deposit Lockers

- AADHAAR Seeding

- CKYC

- CRAs – Credit Bureaus (Credit Reporting Agencies)

ATM Services

Our Bank offers you the convenience of 8 ATMs in each service outlet @ Ottapalam taluk, the largest network in ottapalam and continuing to expand fast!This means that you can transact free of cost on-us transactions at the ATMs of Ottapalam co operative urban banks.

Type Of Cards Accepted

Cards issued by other banks displaying Maestro, Master Card, Cirrus, VISA .

ATM Feature

- 24*7 Fund availability

- Cash Withdrawal :On us customers to withdraw up to a daily limit of Rs. 20,000/- without any charges.

- Fast Cash :A service which enables you towithdraw your preferred amounts with just a touch,The options in the denomination of 100, 200, 500, 1000, 2000 etc

- Pin Change :to change your password at regular intervals

- Balance Enquiry :Use this service to check the current available balance in your account. This service is also available on the main option screen after swiping your card. You can also Go Green’ by selecting the view option as the balance is displayed on the screen else get a transaction receipt by selecting print.

- Mini Statement :Keep track of the transactions in your account by availing this service. Mini-statement gives you an insight into the last 10 transactions in your account.

Safe Deposit Lockers

Features

- Safe Deposit Locker facility is one of the ancillary services provided by the Bank to its customers.

- Lockers Branches are equipped with high security features and specially built strong rooms.

- Hassle-free payment options through your OCU Bank Account.

- Extended banking hours for accessing lockers.

- Nomination facility available

- Nomination on safe-deposit lockers enables OCU Bank to release the contents to the nominee of the person hiring in the event of their death.

- If a locker is held jointly, and one of the people hiring dies, the contents can only be removed jointly by the nominee(s) and the survivors

- The nomination facility is available to anyone hiring a locker.

- For those hiring on an individual basis; nomination can be made in favour of one individual

- For those hiring jointly: nomination can be made in favour of two individuals

- Unpaid locker rentals are recovered from the nominee

- If the hirer is major and the nominee is minor, the nomination will be made by someone lawfully entitled to act on behalf of the minor

Eligibility

Lockers can be hired by individuals, limited companies, associations and trusts.

Locker Rent

Locker rates vary based on locker sizes. Locker rent is charged annually and rent is payable in advance.

| LOCKER TYPE | LOCKER RENT |

| LARGE | 2000 + Applicable GST |

| MEDIUM | 1000 + Applicable GST |

| SMALL | 750 + Applicable GST |

AADHAAR Seeding

Aadhaar Seeding Process :

Aadhaar seeding is necessitated for receiving Direct Benefit Transfers (DBT) provided by various Government schemes. The following is the process flow of Aadhaar seeding

- Customer to visit the bank branch where he / she is holding an account and submit the duly filled consent form Annexure I

- The bank officials after verifying the details and documents provided (as may be required) and authenticity of the customer based on the signature will accept Aadhaar seeding consent form and provide an acknowledgement to the customer.

- The branch will then link the Aadhaar number to the customer’s account and also in NPCI mapper.

- Once this activity is completed and Aadhaar number will reflect in NPCI mapper

Role of theCustomer:

- Submit the consent form with complete details either in physical or electronic form as per the facility provided by his / her bank.

- In case of moving Aadhaar number from one bank to another bank, the customer should provide the name of the bank from which the Aadhaar is being moved.

- In case of physical form, the consent form should be duly signed as per the bank records.

- After seeding is completed the customer may approach their Gas service provider (Oil Marketing Company) for the pending subsidy amount.

- For non-receipt of subsidies customer to approach respective OMC’s through their toll free number : 1800 2333 555

Role of the Bank / Branch:

- Verifying the completeness of the consent form, checking the documentation and authenticating the customer’s signature.

- After the officials are satisfied with the documentation they should carry out the following activities a. Linking the Aadhaar number to the bank account (in CBS) b. Updating NPCI mapper Note: By linking the Aadhaar number to the account the branch is not updating the mapper. The mapper update process has to be followed by their central team or IT division as the case may be.

- After the mapper files are uploaded the response files received from NPCI have to be verified.

- In case of failure in updating any Aadhaar number/s then necessary corrective action has to be taken and CBS also should be updated accordingly.

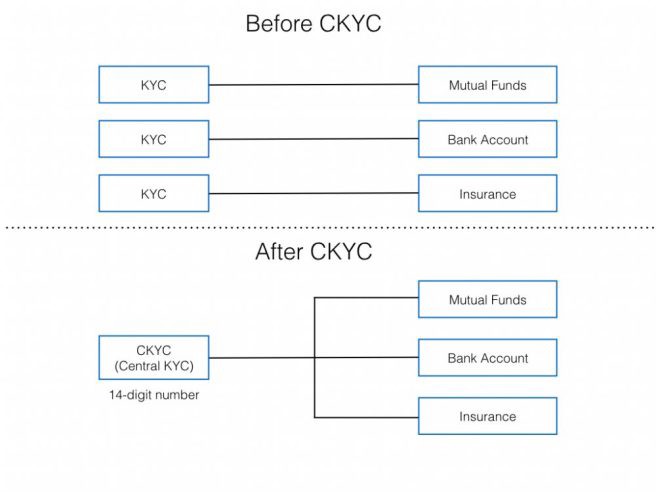

CKYC (Central Know Your Customers)

Central KYC Registry is a centralized repository of KYC records of customers in the financial sector with uniform KYC norms and inter-usability of the KYC records across the sector with an objective to reduce the burden of producing KYC documents and getting those verified every time when the customer creates a new relationship with a financial entity.

Why Central KYC?

Earlier customers had to do different KYC for different purposes ; opening a bank account, buying an insurance, investing in mutual funds etc. With CKYC, this will have to be done just once. CKYC will replace all other KYC processes.

Features

- CKYC will have a unique KYC identifier 14-digit KYC Identification Number (KIN) or a CKYC number -linked with ID proof. You can use this to invest in mutual funds or to purchase any financial product.

- KYC data and documents stored in a digitally secure electronic format.

- ID authentication with issuing authorities like Aadhaar/PAN.

- Institutions will get real-time notifications on any changes in KYC details

List of documents needed for CKYC

- Filled form

- PAN Card

- Identity Proof passport, driver’s license, aadhar card, voter id etc are valid proofs

- Address Proof passport, driver’s license etc are valid proofs

Once you provide the document to Your home branch will starts the uploading process

How to check your CKYC Number?

You can check your CKYC number from CVL or Karvy.

Here is the process for finding your CKYC number:

Visit https://www.karvykra.

CRAs – Credit Bureaus (Credit Reporting Agencies)

A credit rating agency or CRA is an organisation that evaluates the creditworthiness of an individual along with their ability to payback the loan amount and other debts. These credit bureaus provide a credit score of individuals that help banks determine whether an individual is worthy of taking a loan based on his or her financial history.

Money is probably an essential factor in everyone’s life; however, not everyone is in a position to fulfil their financial securities. This is why you have banks and NBFCs (Non-Banking Financial Companies) to help you acquire the financial independence, determined by your capacity to pay. The credit industry is worth billions of dollars and offers credit to multiple individuals on a daily basis. This not only helps in meeting your financial need but also helps you to secure your dream material desire.

Credit Bureaus came into existence in the late 1980s and have ever since been instrumental in determining the nature and integrals involved in a loan. Each credit bureau vies to make life simpler for individual consumers and companies by providing a detailed analysis of their credit history. There are six main Credit Bureaus in India registered under SEBI, namely:

- TransUnion Credit Information Bureau (India) Limited (or CIBIL)

- Credit Rating Information Services of India Limited (CRISIL)

- Equifax

- ICRA (formerly known as Investment Information and Credit Rating Agency of India Limited)

- CRIF High Mark

- Experian

What is the Difference?

CIBIL

This is probably one of the most popular credit bureaus in India and is associated with a large number of NBFCs and Banks. CIBIL came into play in 2000 and has been steadily providing individuals a comprehensive report to help them acquire loans and fulfil their financial requirements. The individuals are scored on parameters ranging from 300 to 900, where 900 is the best and 300 is the lowest. Higher your score better are your chances of acquiring Credit Cards or loans.

If you are applying for loans or Credit Cards in India, CIBIL comes handy in asserting your creditworthiness. The products offered by CIBIL for individuals are Market Insights, CIBIL TransUnion Score, Credit Information Report, and so on. For Companies, you can get Portfolio reports, CIBIL Bureau Analyser and CIBIL company credit information report, and so on. It takes approximately 7 days to process the report.

Experian

It was established in 2006 and granted a fully functional license in 2010. They, too, provide a credit rating from 300 to 900, where 900 is considered to be the best.

For individual consumers, you can get access to Experian credit information report that will help determine your credit history. For companies, you can acquire a Customer acquisition report, collection and money recovery report, customer targeting and engagement, data and analytics amongst others. It is cheaper to get an Experian report and takes approximately 20 days to process.

Equifax

It was granted a fully functional license in 2010 and scores individuals from 1 to 999, with 999 being the highest. As a consumer, you can acquire credit information report, Equifax risk score, Equifax portfolio score, and so on. As a company, you are viable to get credit fraud and risk management report, portfolio management, complete industry diagnostics, and others.

CRIF High Mark

It is India’s sole comprehensive credit rating company that provides seamless services to every type of borrower. This includes MSMEs, commercial borrowers, retail consumers and microfinance borrowers, amongst others.

It was established in 2007 and was granted a license in 2010. Banks that issue Credit Cards are also covered by High Mark to evaluate their standing in the market. Its scores range from 300 to 850, with 720 and above being the highest and 640 and below being poor. For consumers, CRIF provides geo analytics consulting, High Mark credit report, portfolio management, and so on. For companies, you can get access to PERFORM score, High Mark credit report and portfolio management, amongst others.

Our Presents In this:

We are one of the value customers of Four Major Credit Reporting Agencies since 2017 onwards ,by the way our customers can get the Credit scores from these CRAs.

- CIBIL ,

- Equifax ,

- CRIF High Mark ,

- Experian